How to Plan and Budget for Property Taxes.

Ahhh the joys of home ownership. This is the first in a series about budgeting for your home, I take my finances very seriously, and encourage you to learn and understand as much as you can before buying a home.

Quick personal note, I don’t want to listen to people complain about property taxes, if you are privileged enough to be able to purchase a home these days stop whining. Property taxes are a crucial source of revenue for local governments, funding essential public services and infrastructure that benefit communities. So if you want the fire department to show up fast if your home is on fire, just pay your taxes and chill.

This is not financial advice, I am not a financial expert this is just what I do and what works for our family.

Most people worry about coming up with a down-payment for their first home. It can take a long time to accumulate enough money, and it seems damn near impossible for most Americans. Start with some research and do yourself a favor with some real financial planning.

Planning and budgeting for property taxes is a crucial aspect of homeownership that ensures financial stability and prevents unexpected financial strain. Here's an updated and expanded guide to help you navigate this essential responsibility:

Understanding Property Taxes

Property taxes are levied by local governments to fund public services such as schools, emergency services, parks, and infrastructure. The amount you owe is typically based on your property's assessed value and the local tax rate. It's important to note that property tax rates and assessment methods can vary significantly depending on your location.

Before we purchased our home, we were living just south of San Francisco. We initially lived in the Mission and had the joy of our rent increasing by 15% after our first year. Realizing that we really wanted more control over our finances in the future we decided to move south to save money. Our next apartment was a total shithole (we just thought it was outdated but we were wrong), I’m not kidding, we had quite an issue with rats & raccoons in our walls. I’ll spare you the gross details. Let’s just say our cat Templeton was a pretty big asset.

Property taxes vary depending on where you live, so it’s important to include this when you look at your total cost of living.

We live in a higher taxed state and county, but that doesn’t bother me because we consider it part of paying for the community that we want to live in. When you look at a property tax bill it includes your base tax which is usually a specified % of the total value of your home, plus taxes to cover schools, and shared resources such as emergency services, public parks, transit, and even storm drains, and mosquito control.

It’s also important to understand that bond measures can be added to your property taxes during elections in California. This means that everyone, including people that don’t own homes decided how much home owners should be responsible for paying. Once measures are voted on the county treasurer handles the rest.

Estimating Your Property Taxes

To accurately budget for property taxes:

Research Local Tax Rates: Contact your local tax assessor's office or visit their website to find the current property tax rate in your area.

Determine Assessed Value: Understand how your property is assessed and obtain its current assessed value. Keep in mind that assessments can change annually based on market conditions and improvements made to the property.

Calculate Annual Tax Liability: Multiply the assessed value by the tax rate to estimate your annual property tax bill. Be aware that additional levies or bond measures approved by voters can increase this amount.

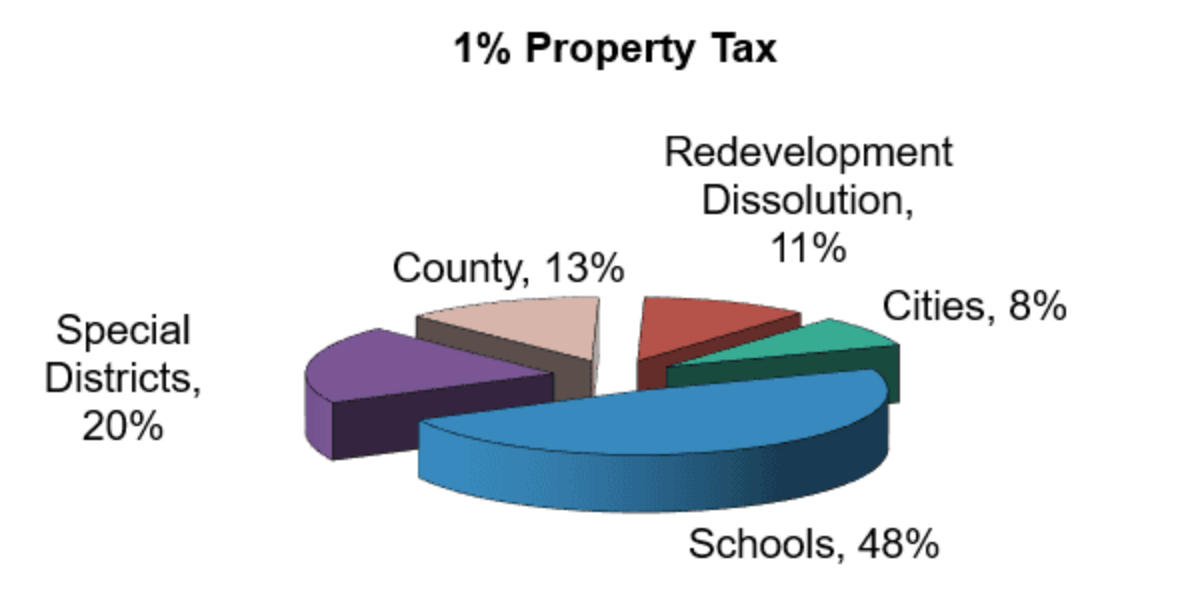

Here’s a breakout of the Contra Costa Property Tax Breakout

Ok, so now what? Time to make a plan, so you don’t dread when property taxes are due.

Budgeting Strategies

Once you have an estimate, one of the following happens.

Monthly Savings Plan: Divide your annual property tax amount by 12 and set aside that amount each month into a dedicated savings account. This approach ensures you have the necessary funds when taxes are due and can earn interest on your savings in the meantime.

Escrow Accounts: If you have a mortgage, your lender may offer an escrow account option, where a portion of your monthly mortgage payment is allocated toward property taxes and homeowners insurance. The lender then pays these bills on your behalf when they're due. While convenient, this means the lender holds your funds, and you may not earn interest on them.

Once you apply for a mortgage loan some banks require an escrow account and some don’t. This is a great question to ask your lender early in the process.

This means that in addition to your mortgage payment, your bank lender includes another fee that accumulates each month and then they pay your property taxes and insurance with that money. The benefit of this is that you aren’t hit with a large expense twice a year when property taxes are due. However, you are also trusting that your bank pays this on time and there are no hiccups.

We prefer a lower monthly payment to the bank and create our own “sinking fund” savings account to pay these bills. Read more about how to create a sinking fund here.

We essentially do the same thing that the bank does, we automatically move a set amount of money each month to a high yield savings account (HYSA). This money sits there and earns interest and then when property taxes are due we have the exact amount ready to go.

So, instead of the bank earning interest on your money, you are earning the interest and accumulating more money until the payment is due.

I also like that you can also just front load it and not worry about moving money every month. This works if you put part of a bonus or tax refund into the account to lower the amount you need to set aside each month.

This only works if you stick to your monthly plan and don’t touch that account for any other reason. For some people it can be tempting to dip into when needed, but it feels good to not stress about writing that big check twice a year.

There is not right or wrong answer, you need to do what works best for you.

Staying Informed

Monitor Assessments: Regularly review your property's assessed value for accuracy. If you believe it's incorrect, you can appeal the assessment through your local tax assessor's office.

Be Aware of Tax Law Changes: Stay informed about changes in tax laws that may affect your property taxes. For instance, upcoming changes to the state and local tax (SALT) deduction cap could impact your federal tax deductions related to property taxes.

Plan for Increases: Be prepared for potential increases in property taxes due to rising property values, new bond measures, or changes in local government budgets. Regularly setting aside funds can help mitigate the impact of these increases.

These aren’t just practical boxes to check—they’re what make the difference between ignoring your outdoor space… and actually using it.